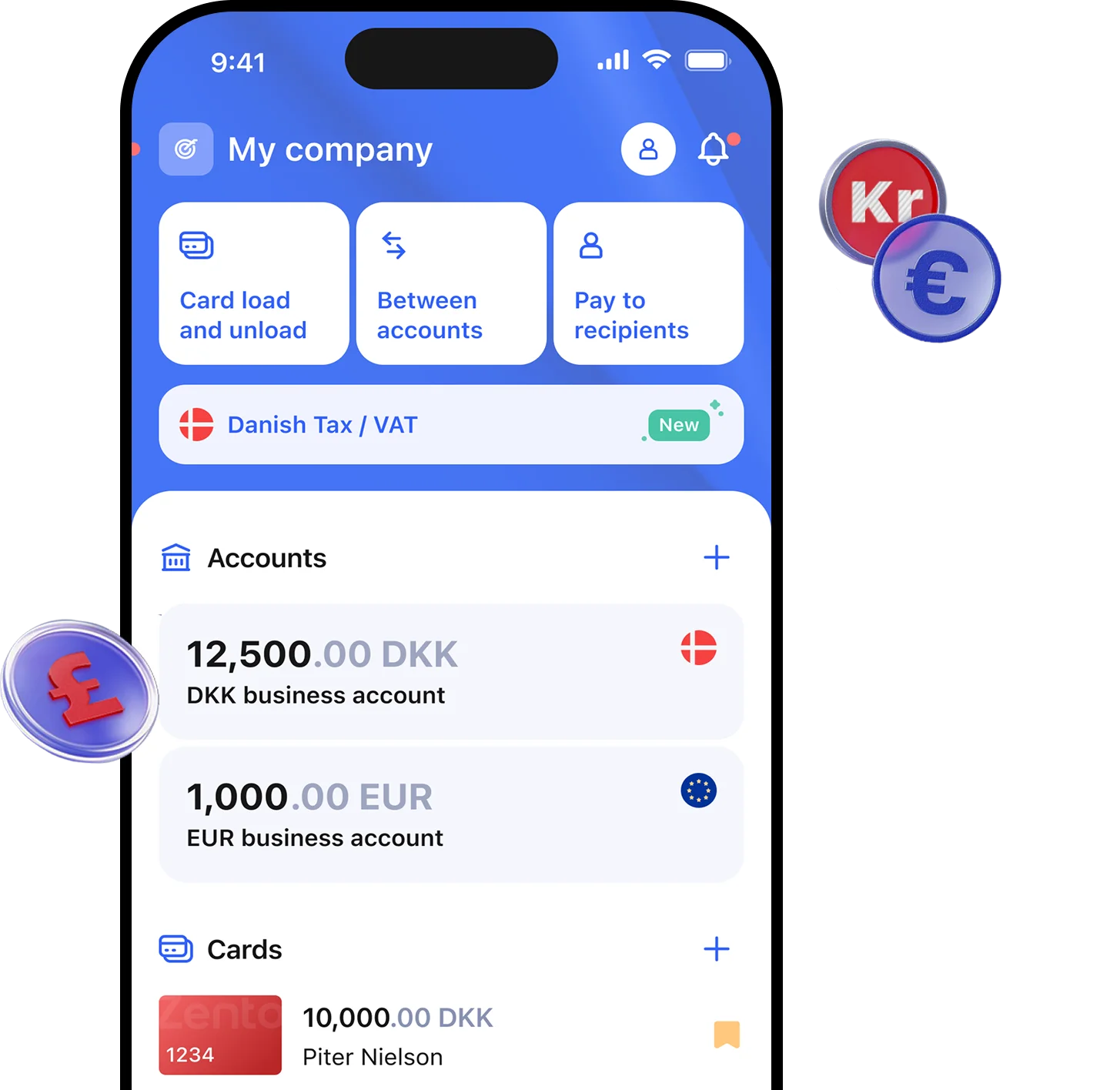

Accounts

Business accounts in 32 currencies for European companies and sole traders

Business accounts in 32 currencies for European companies and sole traders

Send and receive payments via SEPA, SWIFT and local payment systems

Exchange any currency in a few clicks, with low fees

Physical and virtual cards will be available in Q1 2026

Zento believes in financial inclusivity, providing fair and accessible onboarding for European businesses.

The application process only takes a few minutes. Zento usually reviews and approves within 1 business day. Once approved, accounts are activated immediately!

Through live-chat, email, or by phone. No queues. Save time with Zento.

All operations and data are protected by two-factor authentication. Security policies are always updated to the latest high industry standards.

Entrepreneurs trust us for our transparent pricing model. No hidden fees applied.

Transparent low prices and no hidden fees. Find detailed prices here.

Сountry of incorporation

Leave your number, and we’ll call you back soon

Thank you for your request

A manager will contact you within 1 business day

Oops! Something went wrong. Please try again.

Through Zento, you can access business accounts in 32 currencies including EUR, DKK, SEK and GBP, to send and receive payments and do currency exchange.

Our secure web and mobile platform lets you easily send, receive and manage payments.

Zento offers plans based on your preffered currency and payment volumes:

Yes. EMIs must keep client funds separate under strict European regulations, ensuring protection even in financial difficulties. National regulators oversee compliance, and funds are held securely with financial institutions.

The application process only takes a few minutes. Zento usually reviews and approves within 1 business day. Once approved, accounts are activated immediately!

For each account opened with Zento, we plant a tree. Yes, a real tree. Join us, and help making Earth a better place!

Thank you for your request

A manager will contact you within 1 business day